All Categories

Featured

Table of Contents

Understanding the different death advantage options within your inherited annuity is necessary. Thoroughly evaluate the contract information or talk to a financial expert to identify the details terms and the most effective means to proceed with your inheritance. As soon as you acquire an annuity, you have several alternatives for obtaining the cash.

In some instances, you could be able to roll the annuity into an unique sort of specific retired life account (IRA). You can select to get the entire continuing to be balance of the annuity in a solitary settlement. This option uses immediate accessibility to the funds yet includes major tax obligation consequences.

If the inherited annuity is a professional annuity (that is, it's held within a tax-advantaged retired life account), you may be able to roll it over right into a brand-new retirement account (Fixed annuities). You don't need to pay tax obligations on the rolled over amount.

Single Premium Annuities and inheritance tax

Other kinds of recipients generally need to take out all the funds within one decade of the owner's death. While you can not make extra contributions to the account, an acquired IRA uses a beneficial benefit: Tax-deferred growth. Incomes within the acquired IRA gather tax-free until you begin taking withdrawals. When you do take withdrawals, you'll report annuity income in the very same means the strategy individual would certainly have reported it, according to the IRS.

This alternative gives a stable stream of earnings, which can be valuable for lasting financial preparation. There are different payout options available. Typically, you have to start taking circulations no much more than one year after the proprietor's fatality. The minimum quantity you're needed to withdraw yearly after that will be based upon your own life span.

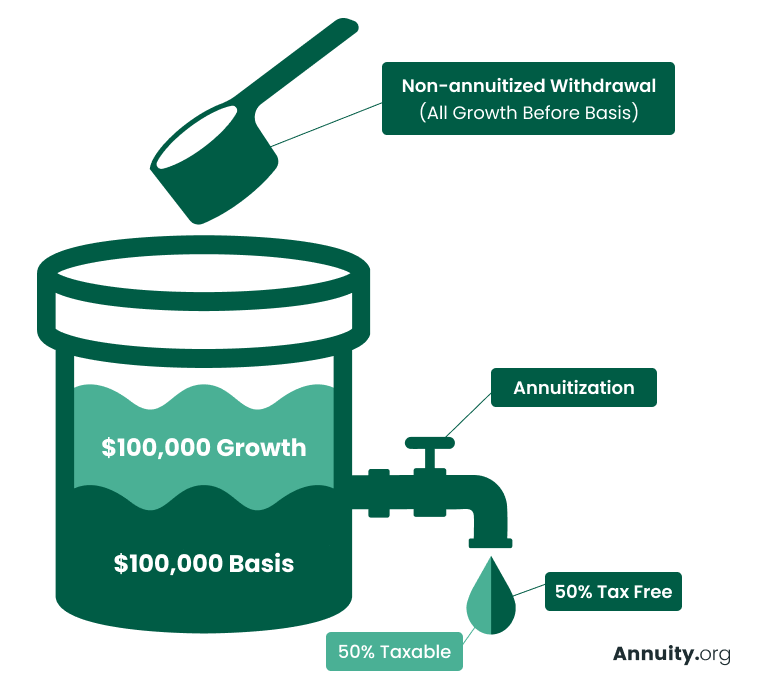

As a recipient, you will not undergo the 10 percent internal revenue service very early withdrawal charge if you're under age 59. Trying to determine taxes on an acquired annuity can feel intricate, however the core principle focuses on whether the contributed funds were formerly taxed.: These annuities are funded with after-tax bucks, so the beneficiary typically does not owe taxes on the initial payments, but any type of profits built up within the account that are distributed go through normal revenue tax.

Retirement Annuities and inheritance tax

There are exceptions for partners that inherit qualified annuities. They can normally roll the funds into their very own IRA and delay tax obligations on future withdrawals. Regardless, at the end of the year the annuity business will submit a Type 1099-R that demonstrates how a lot, if any kind of, of that tax obligation year's distribution is taxed.

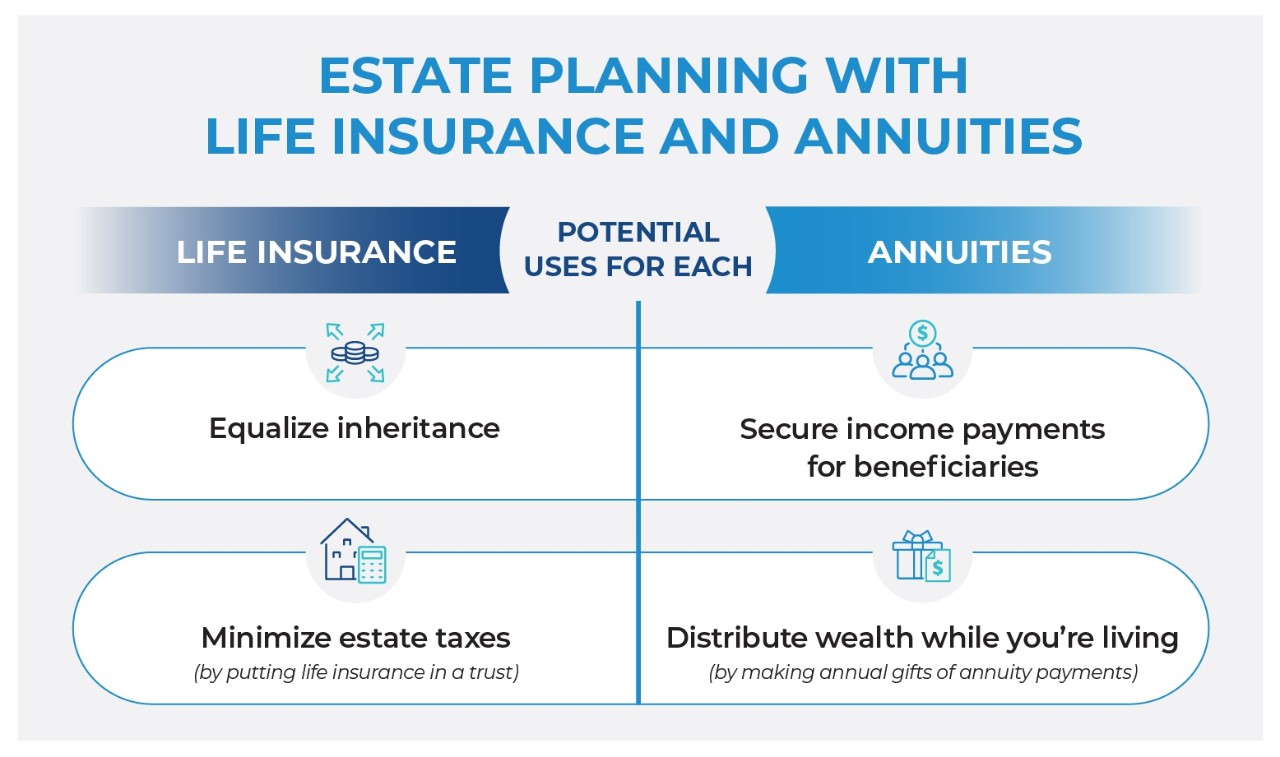

These tax obligations target the deceased's complete estate, not just the annuity. These taxes usually only impact very large estates, so for the majority of beneficiaries, the focus should be on the income tax obligation implications of the annuity. Acquiring an annuity can be a complicated however possibly monetarily beneficial experience. Comprehending the terms of the agreement, your payout options and any type of tax obligation ramifications is essential to making informed choices.

Annuity Beneficiary and inheritance tax

Tax Therapy Upon Death The tax treatment of an annuity's death and survivor advantages is can be fairly complicated. Upon a contractholder's (or annuitant's) death, the annuity might undergo both earnings tax and inheritance tax. There are various tax therapies depending on that the recipient is, whether the proprietor annuitized the account, the payout approach picked by the beneficiary, and so on.

Estate Taxes The government estate tax obligation is a highly dynamic tax (there are numerous tax braces, each with a greater price) with prices as high as 55% for large estates. Upon fatality, the internal revenue service will certainly consist of all property over which the decedent had control at the time of death.

Any type of tax in excess of the unified debt is due and payable 9 months after the decedent's fatality. The unified credit history will completely shelter relatively small estates from this tax obligation.

This conversation will concentrate on the estate tax obligation therapy of annuities. As held true during the contractholder's life time, the IRS makes an essential difference in between annuities held by a decedent that remain in the buildup stage and those that have actually gone into the annuity (or payout) stage. If the annuity is in the build-up phase, i.e., the decedent has actually not yet annuitized the contract; the full survivor benefit assured by the agreement (consisting of any improved survivor benefit) will certainly be consisted of in the taxable estate.

Tax on Tax-deferred Annuities death benefits for beneficiaries

Instance 1: Dorothy possessed a repaired annuity agreement released by ABC Annuity Company at the time of her fatality. When she annuitized the agreement twelve years ago, she selected a life annuity with 15-year duration particular.

That worth will certainly be included in Dorothy's estate for tax obligation functions. Upon her death, the payments quit-- there is nothing to be paid to Ron, so there is nothing to consist of in her estate.

Two years ago he annuitized the account choosing a life time with cash refund payout alternative, calling his little girl Cindy as recipient. At the time of his death, there was $40,000 major continuing to be in the agreement. XYZ will certainly pay Cindy the $40,000 and Ed's executor will include that amount on Ed's estate tax obligation return.

Considering That Geraldine and Miles were married, the advantages payable to Geraldine represent residential property passing to an enduring partner. Long-term annuities. The estate will certainly be able to utilize the unrestricted marital deduction to avoid taxes of these annuity advantages (the worth of the advantages will certainly be listed on the inheritance tax type, in addition to a countering marital deduction)

Inheritance taxes on Single Premium Annuities

In this case, Miles' estate would certainly consist of the worth of the continuing to be annuity repayments, yet there would be no marital deduction to balance out that incorporation. The very same would use if this were Gerald and Miles, a same-sex couple. Please note that the annuity's continuing to be value is identified at the time of death.

Annuity agreements can be either "annuitant-driven" or "owner-driven". These terms refer to whose death will set off settlement of fatality advantages.

There are circumstances in which one individual possesses the agreement, and the determining life (the annuitant) is somebody else. It would be nice to assume that a particular agreement is either owner-driven or annuitant-driven, however it is not that straightforward. All annuity agreements released since January 18, 1985 are owner-driven due to the fact that no annuity agreements released given that after that will be given tax-deferred standing unless it consists of language that activates a payout upon the contractholder's death.

Table of Contents

Latest Posts

Analyzing Fixed Vs Variable Annuity Pros Cons Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Variable Vs Fixed Annuity Why

Breaking Down Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at Fixed Vs Variable Annuity Pros And Cons What Is the Best Retirement Option? Benefits of Deferred Annuity Vs Variable Annu

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Annuities Fixed Vs Variable What Is Immediate Fixed Annuity Vs Variable Annuity? Pros and Cons of Variable Annuity Vs Fi

More

Latest Posts