All Categories

Featured

Table of Contents

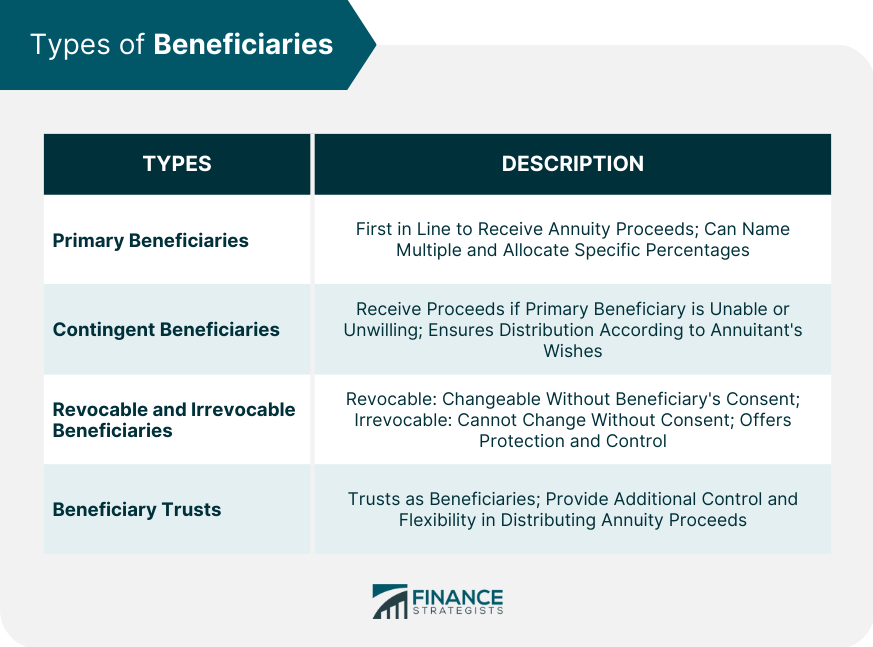

Owners can alter recipients at any type of point during the agreement duration. Proprietors can pick contingent recipients in instance a would-be beneficiary passes away before the annuitant.

If a married pair owns an annuity jointly and one companion dies, the making it through partner would certainly remain to receive repayments according to the terms of the agreement. To put it simply, the annuity remains to pay as long as one spouse stays alive. These agreements, often called annuities, can additionally include a third annuitant (commonly a youngster of the pair), that can be marked to receive a minimal variety of settlements if both partners in the initial agreement pass away early.

How is an inherited Tax-deferred Annuities taxed

Below's something to keep in mind: If an annuity is sponsored by a company, that business has to make the joint and survivor plan automatic for couples who are wed when retirement occurs., which will certainly impact your regular monthly payment in different ways: In this case, the regular monthly annuity payment stays the very same following the death of one joint annuitant.

This kind of annuity may have been bought if: The survivor intended to handle the monetary obligations of the deceased. A pair handled those responsibilities with each other, and the making it through companion intends to prevent downsizing. The surviving annuitant obtains only half (50%) of the monthly payment made to the joint annuitants while both lived.

Tax implications of inheriting a Long-term Annuities

Many contracts permit a surviving partner detailed as an annuitant's beneficiary to transform the annuity into their own name and take control of the first agreement. In this situation, called, the surviving spouse becomes the new annuitant and gathers the staying repayments as scheduled. Partners likewise may elect to take lump-sum settlements or decline the inheritance in support of a contingent recipient, that is qualified to get the annuity only if the key beneficiary is incapable or resistant to approve it.

Squandering a swelling sum will certainly cause varying tax responsibilities, relying on the nature of the funds in the annuity (pretax or already exhausted). But taxes will not be incurred if the partner remains to receive the annuity or rolls the funds into an IRA. It may seem weird to mark a small as the beneficiary of an annuity, but there can be good reasons for doing so.

In other situations, a fixed-period annuity may be made use of as a vehicle to fund a kid or grandchild's college education and learning. Minors can't inherit money directly. A grown-up should be assigned to manage the funds, comparable to a trustee. There's a difference between a depend on and an annuity: Any money appointed to a trust must be paid out within five years and lacks the tax obligation benefits of an annuity.

A nonspouse can not usually take over an annuity contract. One exemption is "survivor annuities," which give for that contingency from the creation of the contract.

Under the "five-year regulation," beneficiaries may defer asserting money for up to five years or spread repayments out over that time, as long as all of the money is gathered by the end of the 5th year. This enables them to spread out the tax burden in time and might keep them out of higher tax obligation braces in any kind of single year.

Once an annuitant passes away, a nonspousal beneficiary has one year to establish up a stretch circulation. (nonqualified stretch provision) This format sets up a stream of earnings for the remainder of the recipient's life. Because this is established up over a longer duration, the tax effects are normally the smallest of all the options.

What taxes are due on inherited Annuity Cash Value

This is occasionally the instance with prompt annuities which can begin paying out instantly after a lump-sum financial investment without a term certain.: Estates, trusts, or charities that are beneficiaries should withdraw the agreement's full value within 5 years of the annuitant's fatality. Tax obligations are affected by whether the annuity was moneyed with pre-tax or after-tax dollars.

This just implies that the money bought the annuity the principal has actually currently been tired, so it's nonqualified for tax obligations, and you don't have to pay the internal revenue service again. Only the rate of interest you earn is taxed. On the other hand, the principal in a annuity hasn't been taxed.

When you take out money from a qualified annuity, you'll have to pay tax obligations on both the passion and the principal. Earnings from an acquired annuity are dealt with as by the Internal Revenue Service.

If you acquire an annuity, you'll have to pay income tax obligation on the difference between the major paid into the annuity and the value of the annuity when the owner dies. If the proprietor acquired an annuity for $100,000 and earned $20,000 in rate of interest, you (the recipient) would certainly pay taxes on that $20,000.

Lump-sum payments are exhausted all at as soon as. This option has one of the most extreme tax consequences, due to the fact that your income for a solitary year will certainly be a lot greater, and you may end up being pressed right into a higher tax brace for that year. Progressive payments are strained as earnings in the year they are obtained.

For how long? The typical time is concerning 24 months, although smaller sized estates can be taken care of much more promptly (in some cases in as little as six months), and probate can be also much longer for even more complicated instances. Having a legitimate will can speed up the procedure, yet it can still obtain slowed down if beneficiaries challenge it or the court needs to rule on that need to provide the estate.

Inheritance taxes on Guaranteed Annuities

Since the person is named in the agreement itself, there's absolutely nothing to competition at a court hearing. It is essential that a certain person be named as recipient, as opposed to simply "the estate." If the estate is named, courts will examine the will to sort points out, leaving the will open up to being disputed.

This may deserve considering if there are reputable bother with the individual called as recipient diing before the annuitant. Without a contingent recipient, the annuity would likely then come to be based on probate once the annuitant passes away. Talk to an economic advisor about the potential advantages of calling a contingent recipient.

Table of Contents

Latest Posts

Analyzing Fixed Vs Variable Annuity Pros Cons Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Variable Vs Fixed Annuity Why

Breaking Down Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at Fixed Vs Variable Annuity Pros And Cons What Is the Best Retirement Option? Benefits of Deferred Annuity Vs Variable Annu

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Annuities Fixed Vs Variable What Is Immediate Fixed Annuity Vs Variable Annuity? Pros and Cons of Variable Annuity Vs Fi

More

Latest Posts